At the beginning of June, Crédit Agricole Group presented a new Group Project and a new 2022 Medium-Term Plan. The new plan is based on three drivers: growth on all our markets, development of revenue synergies and technological transformation for greater efficiency.

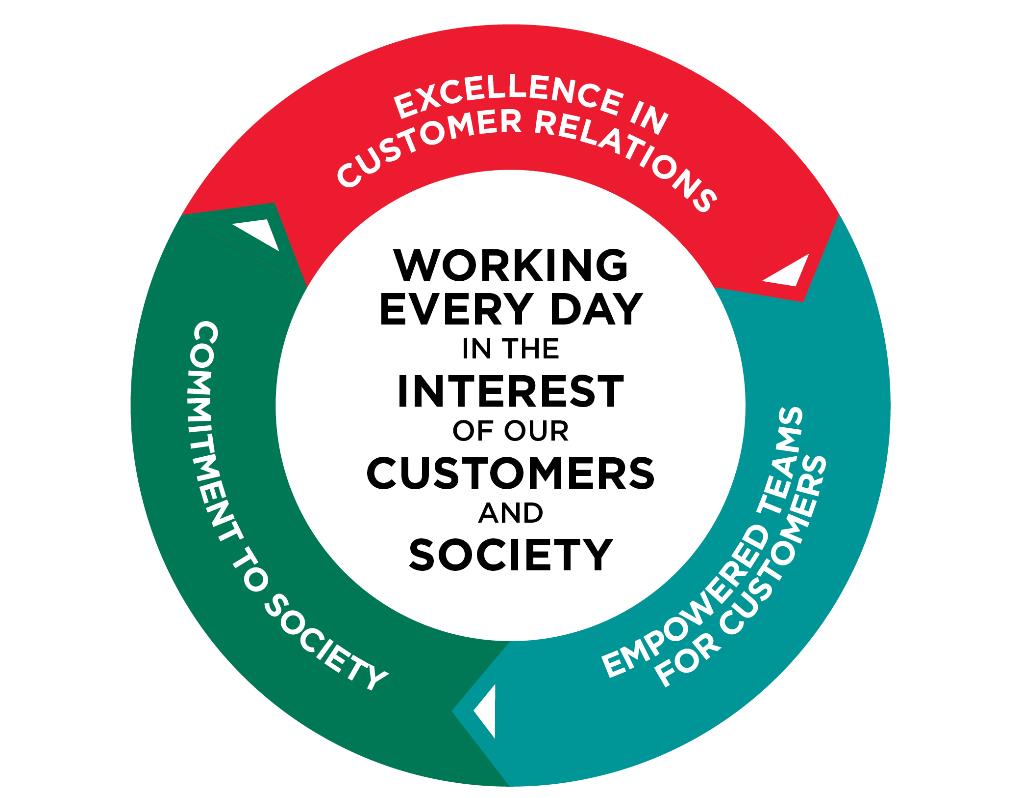

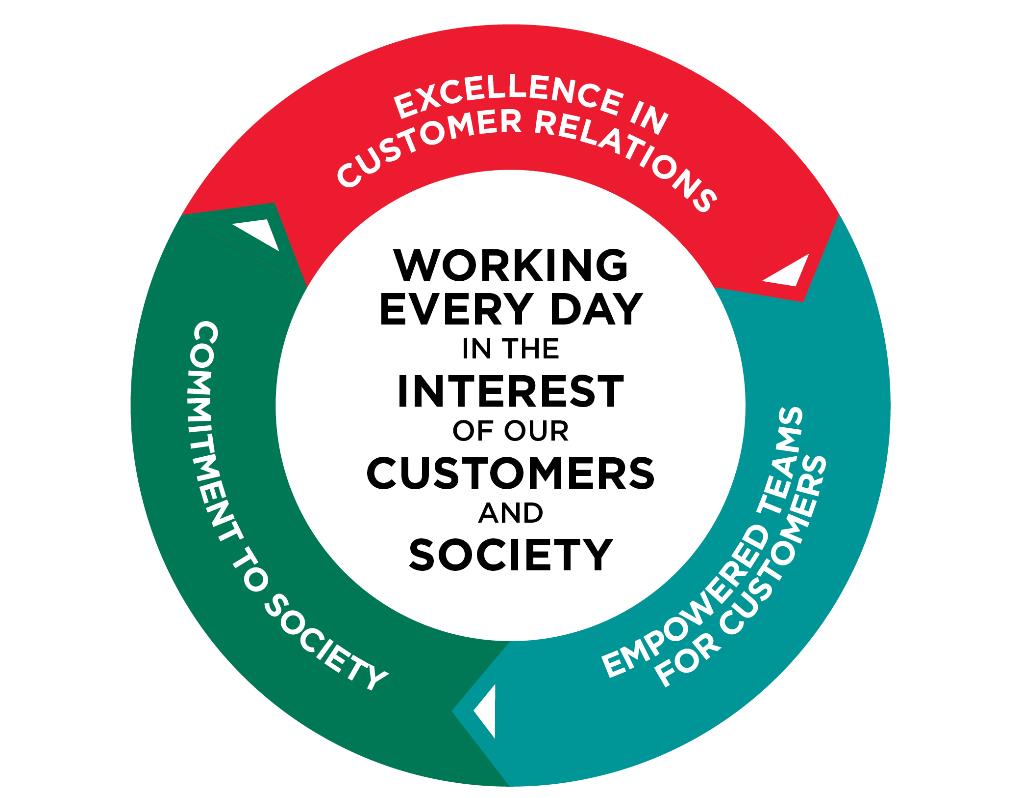

For the first time, the Group Project spells out Crédit Agricole’s Raison d’être. It serves as the basis of its unique relationship model and lies at the heart of its customer-focused universal banking model. Forward-looking and true to the daily expression of the Group’s usefulness, this Raison d’être guides the Group’s transformation and development while promoting its values of usefulness and universality. It can be summarized as “Working every day in the interest of our customers and society”.

Within this new long-term framework, the 2022 strategic plan is a roadmap for profitable growth for Crédit Agricole Group. It builds upon the previous Medium-Term Plan, Strategic Ambitions 2020, which delivered almost all of its financial results a year ahead of schedule. It seeks to amplify and accelerate the Group’s growth in an uncertain environment, and in a context of growing societal expectations.

Crédit Agricole is the number one bank in France, number one insurer in France, number one bancassurer in Europe, number one asset manager in Europe and the world’s tenth largest bank. With 51 million customers around the world and the biggest retail banking customer base in Europe, the Group has built its growth on a unique relationship model, which it intends to expand by drawing on three pillars and growth drivers, synergies and technological improvement in order to achieve these objectives.

Excellence in customer relations at the center of the Customer Project

The customer project has been expanded and targets customer relations excellence by encouraging increased action by all business lines around customer satisfaction; commitment by the whole Group to a “zero error” culture; and offering an exceptional online customer experience and innovative products and services.

Empowered teams at the center of the Human Project

The human project is focused on empowerment at local level. The objective is to offer customers permanent access to a trained, independent and responsive staff in a structure that clearly delegates authority. This process involves managerial transformation, organizational change and a framework of strengthened trust.

A strong commitment to society at the center of the Societal Project

The social project consists in pursuing societal commitment by the Group in favor of all, maintaining the social connection in the regions, developing social impact financing and making “green finance” one of the Group’s keys to growth.

Read more about the new Group Project and a new 2022 Medium-Term Plan on the Group’s site by this link.

Note that new Credit Agricole Ukraine local Medium-Term Plan will be based on Credit Agricole Group Medium-Term Plan and will be introduced additionally.

About Credit Agricole:

JSC «Credit Agricole Bank» is a modern universal bank owned by the leading financial group in Europe – Credit Agricole Group (France). The Group is a major partner of the French economy and one of the largest banking groups in Europe. It is a leading retail bank in Europe, having the largest portfolio of assets under management, being first in the field of ban insurance and third - in project financing in Europe. Credit Agricole has been operating in the financial market of Ukraine since 1993 and renders the entire range of banking services to private individuals, including premium-clients, and business. The bank pays special attention to cooperation with agricultural enterprises. Reliability and business reputation of Credit Agricole in Ukraine is confirmed by the highest possible FITCH ratings, leading positions in bank sustainability, bank deposit reliability and bank profitability rankings, as well as by 280 000 active private and 18 000 corporate customers, including international corporations, large Ukrainian companies and representatives of small and medium business. Credit Agricole Bank is a socially responsible bank that confirms its status by the large number of projects implemented under the Corporate Social Responsibility program «We Care!».

Contacts:

PR and corporate communications division of Credit Agricole Bank.

E-mail: Communications@credit-agricole.ua

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information