What is a benchmark rate?

A benchmark rate is a regularly published figure calculated by a formula based on the value or price of one or more underlying assets. A rate is considered a benchmark when it is used to:

- calculate the interests rate to be paid with regard to a financial instrument or contract;

- determine the value of a financial instrument;

- measure the performance of an investment fund in order to replicate the performance of that benchmark;

- define the asset allocation of a portfolio;

- calculate a fund's performance fees.

Why are benchmark rates important?

They are widely used throughout the economy in financial transactions or for accounting purposes by companies and banks in order to calculate, for instance, the value of their financial assets. They can also be used to calculate the remuneration of deposits or loans.

Benchmark rates are also essential for Central banks since they enable a better grasp of financial markets and liquidity conditions.

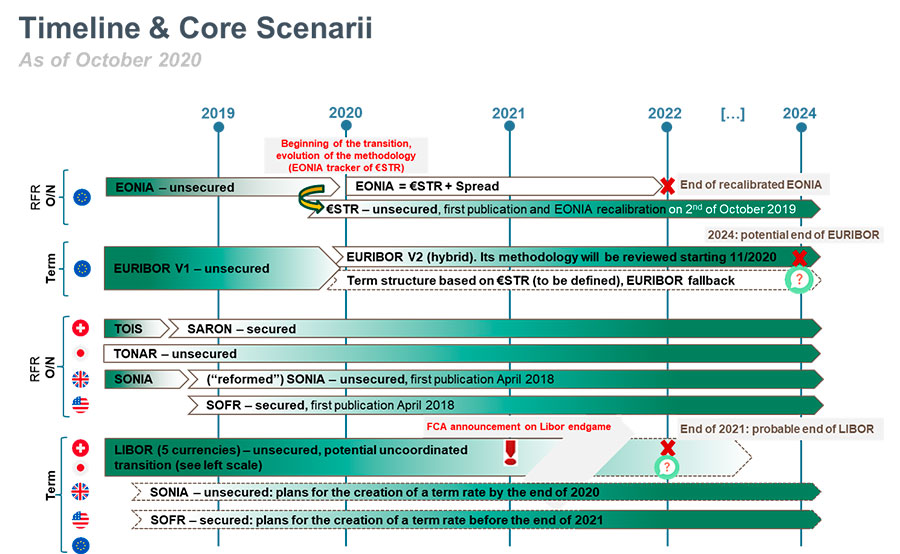

Benchmark rates reforms

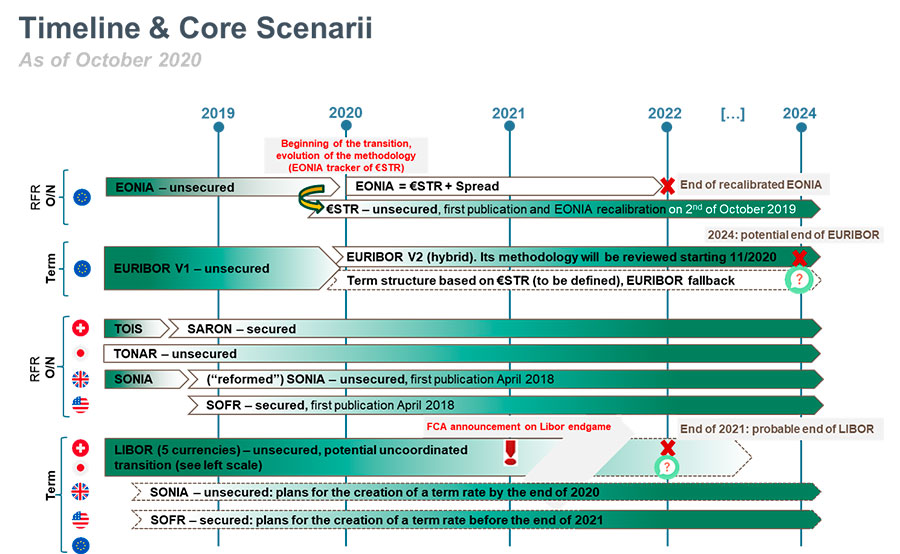

The €STR was established on 2nd October 2019. This new benchmark is conceived to permanently replace the EONIA by 2022. This first step in Europe is the result of a worldwide initiative starting in 2013 and expressed within the European Union and EFTA (European Free Trade Association) countries by the BMR (Benchmarks Regulation). In order to meet the requirements of €STR as from the 2nd of October and support all its clients, both individuals and companies, in this transition toward new benchmark rates, Crédit Agricole has launched the Benchmarks project, which coordinates the incremental steps of the transition within the Group as a whole.

Context and risk of LIBOR discontinuation

The London Inter-Bank Overnight Rate (LIBOR) has been in use since the 1980s to calculate interest rates in financial contracts and instruments (such as loans, bonds, and mortgages). LIBOR is now among the most commonly used reference rate benchmarks, used in various currencies for financial contracts with trillions of dollars in outstanding amounts, covering all types of customers, from financial institutions to individual personal customers. LIBOR is also frequently used as a benchmark in fund prospectuses.

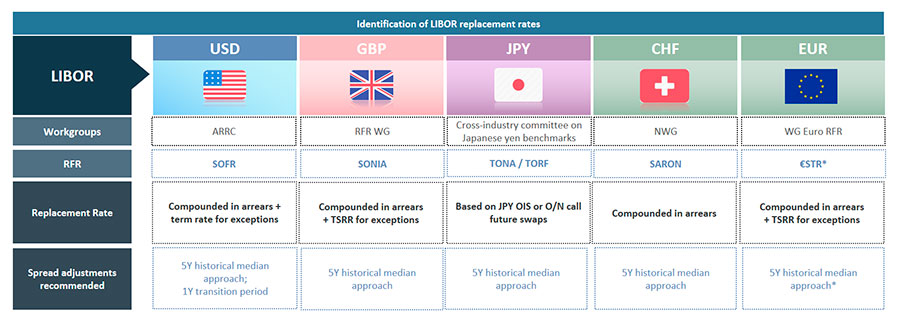

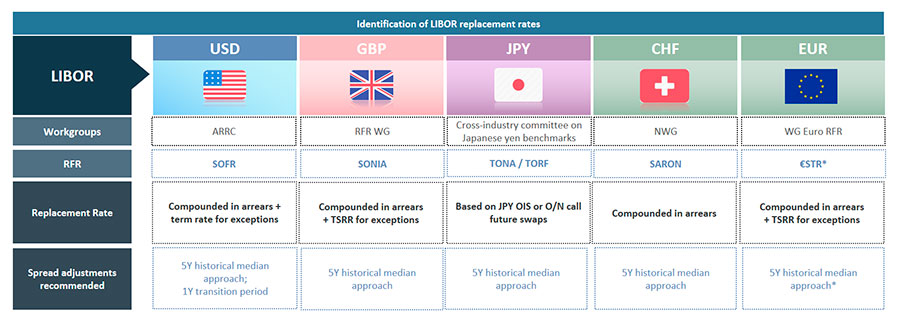

At the request of the G20, the Financial Stability Board (FSB) and International Organization of Securities Commissions (IOSCO) have set key principles to reinforce benchmark rates and develop the use of risks free alternative near risk free rates (RFRs). Banks and other interested parties, with the support of competent authorities, are working to implement these principles.

Notwithstanding this, LIBOR has increasingly been regarded as “non-representative” because of the ongoing reduction of available reference data on which it is based.

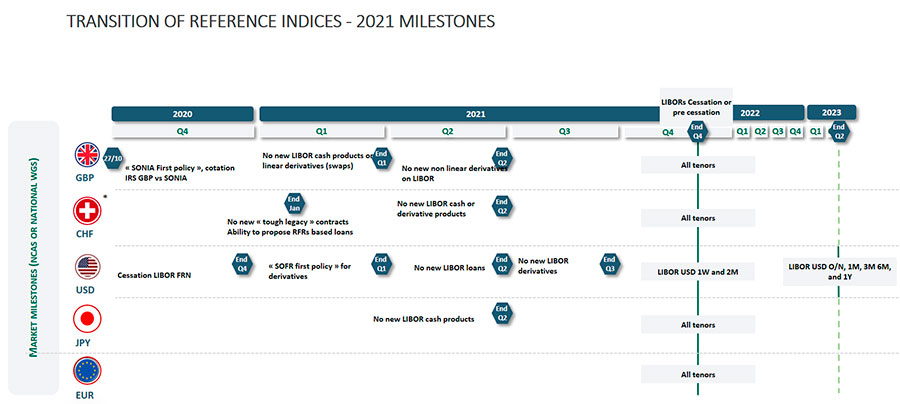

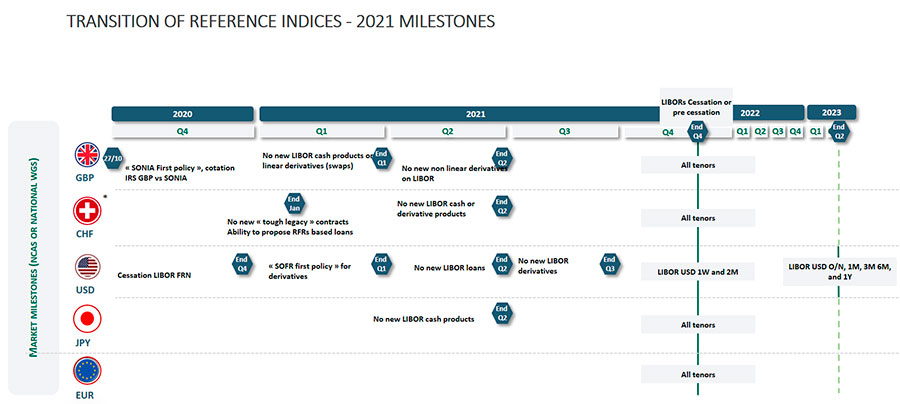

On 16 January 2020, the FCA supported the indicative calendar proposed by the Sterling Working Group, around three milestones:

- 2 March 2020: switch to use of SONIA swaps by market makers encouraged

- By the end of Q3 2020: end of new cash market products including loans using GBP LIBOR

- By the end of Q1 2021: "significant reduction" in the stock of operations referencing GBP LIBOR, to a strict minimum (illustrated by the term "tough legacy" for contracts more difficult to convert to SONIA).

In Europe, this reform takes shape under the BMR published in 2016 and unforceable since the start of 2018. It should be noted that the BMR applies to all asset classes and not just fixed income markets. It reinforces the obligations of administrators, contributors and benchmark users.

Potential impacts

The discontinuation of LIBOR in various currencies and replacement by new alternative reference rates is likely to have impacts of various kinds, in particular:

- Operational (updating of systems as e.g. LIBOR is a forward-looking rate and RFRs are based on historical overnight transactions). Each currency replacement for LIBOR may adopt different times and methods of publication.

- Legal (implementation of fallback clauses to allow for the transition or direct renegotiation of the contract to reference the replacement rate)

- Financial (asset / liability management; spread adjustment between the old and the new index for the legacy and difference between secured and unsecured RFRs according to the currency concerned.

The exact nature of the migration to RFRs – including elements of the transition calendar - have not yet been fully defined, as they are still being discussed by national working groups with the involvement of the relevant supervisory authorities.

It should be noted that, for existing contracts, the transition to a new benchmark rate is likely to require a spread adjustment between LIBOR and that rate, a topic still under discussion within working groups.

Undergoing works

In the major financial centers, “RFRs working groups” have been established by the relevant competent authorities and have participated in the creation of LIBORs RFRs in their local currency, to replace the relevant LIBOR.

The Crédit Agricole Group transition strategy is defined in line with the work of these groups.

For GBP / USD / CHF / JPY, the SONIA (Sterling Over Night Average) / SOFR (Secured Overnight Financing Rate) / SARON (Swiss Average Rate Overnight) / TONAR (Tokyo Overnight Average rate) have been designated as the applicable RFR rate.

SONIA is administered by the Bank of England (BoE)

SOFR is administered by the Federal Reserve Bank of New York (Fed)

SARON is administered by Six Swiss Exchange

TONAR is administered by the Bank of Japan (BoJ)

Forward-looking term rate would be based on a capitalized SONIA / SOFR / SARON / TONAR.

Unlike LIBOR, for SONIA / SOFR / SARON / TONAR, the interest rate would most of the time be definitively known on the next business day following the end of the interest period.

SARON and SOFR are determined on the repo market and are therefore linked to secured transactions, unlike SONIA and TONAR which are based on the unsecured market.

Source: https://www.fca.org.uk/markets/libor

Source: https://www.fca.org.uk/markets/libor

The need to introduce robust fallback clauses

The introduction of robust fallback clauses is an obligation of the benchmark regulations for a scope of financial contracts and instruments, and more generally allows for a smooth transition in case of an effective discontinuation of a benchmark.

Fallback clauses define trigger events of the cessation of publication or the cessation of a benchmark and define the methodologies to determine the replacement benchmark if such trigger event occur. They aim at reducing uncertainties in the event of a temporary or permanent cessation of the used benchmarks.

Finale

We invite you to assess how the possible discontinuation of current benchmarks and the transition to new benchmarks would affect the financing and operation of your business.

We are at your disposal for more information.

Useful links

FCA webpage dedicated to LIBOR transition https://www.fca.org.uk/markets/libor

Fact-sheet on LIBOR transition – Focus on GBP

https://www.bankofengland.co.uk/-/media/boe/files/markets/benchmarks/rfr/factsheet-calling-time-on-libor-why-you-need-to-act-now.pdf?la=en&hash=5832419D3782354BAC3E041E4F5C2860D5D3B75F

FCA webpage dedicated to conduct risk https://www.fca.org.uk/markets/libor/conduct-risk-during-libor-transition

Sterling working group webpage https://www.bankofengland.co.uk/markets/transition-to-sterling-risk-free-rates-from-libor

CHF national working group webpage https://www.snb.ch/fr/ifor/finmkt/fnmkt_benchm/id/finmkt_reformrates

USD working group (ARRC) webpage https://www.newyorkfed.org/arrc

JPY working group webpage https://www.boj.or.jp/en/paym/market/jpy_cmte/index.htm/

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information