On 22 June, Credit Agricole launched its new mobile application СА+. It is already available in App Store and Google Play. Developing new СА+, the bank was driven by the need of customers to get high-quality digital service. New application also combines useful functionalities and nice visual solutions.

New СА+ offers the following advantages and opportunities:

- Rich design and intuitive interface. Enjoy managing your products and funds.

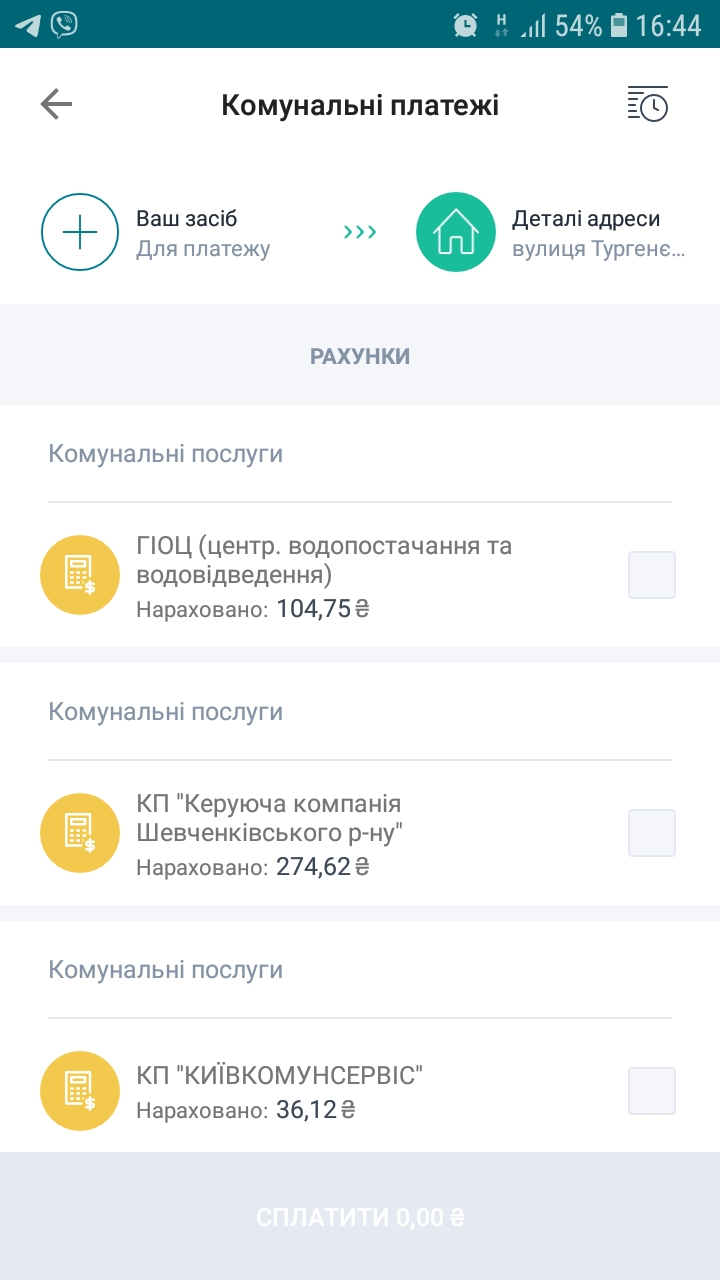

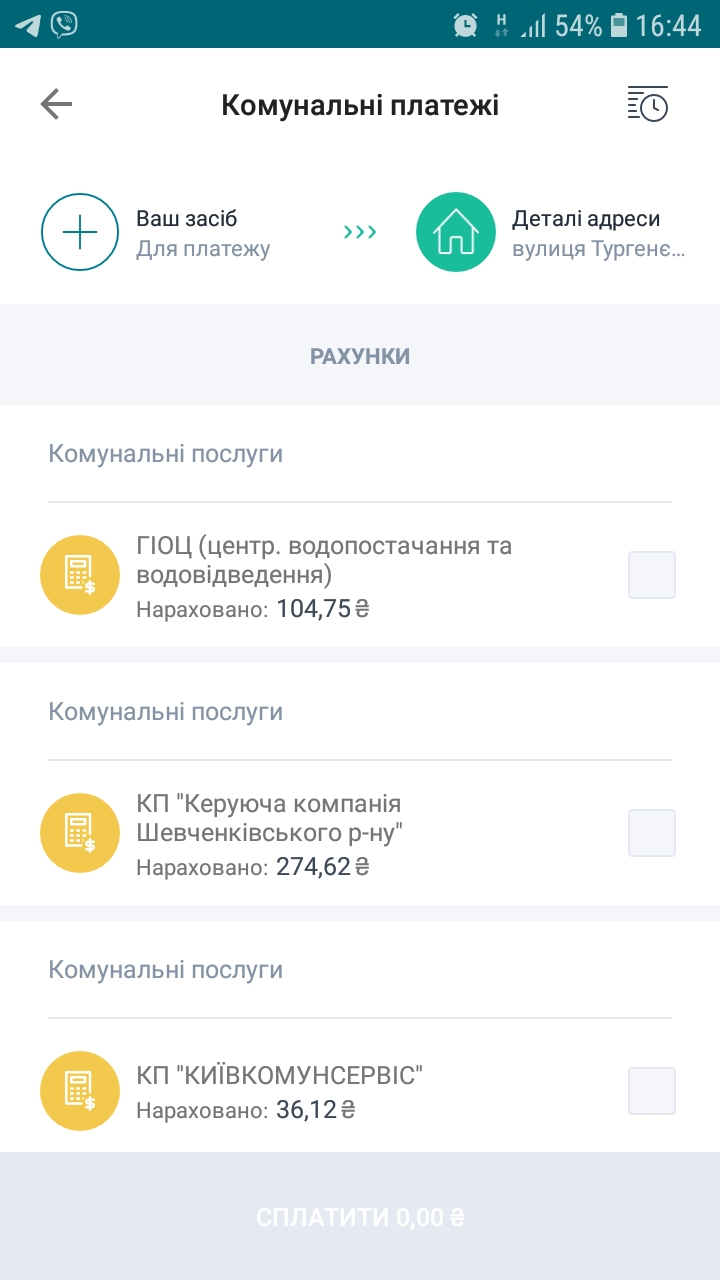

- Utility payments, by the way, without a fee when you pay with Credit Agricole card.

- Currency exchange. Purchase and sale of USD and EUR subject to availability of the respective currency accounts.

- Possibility to save other banks cards in the application. It is more convenient and cheaper to make transfers between cards of different banks.

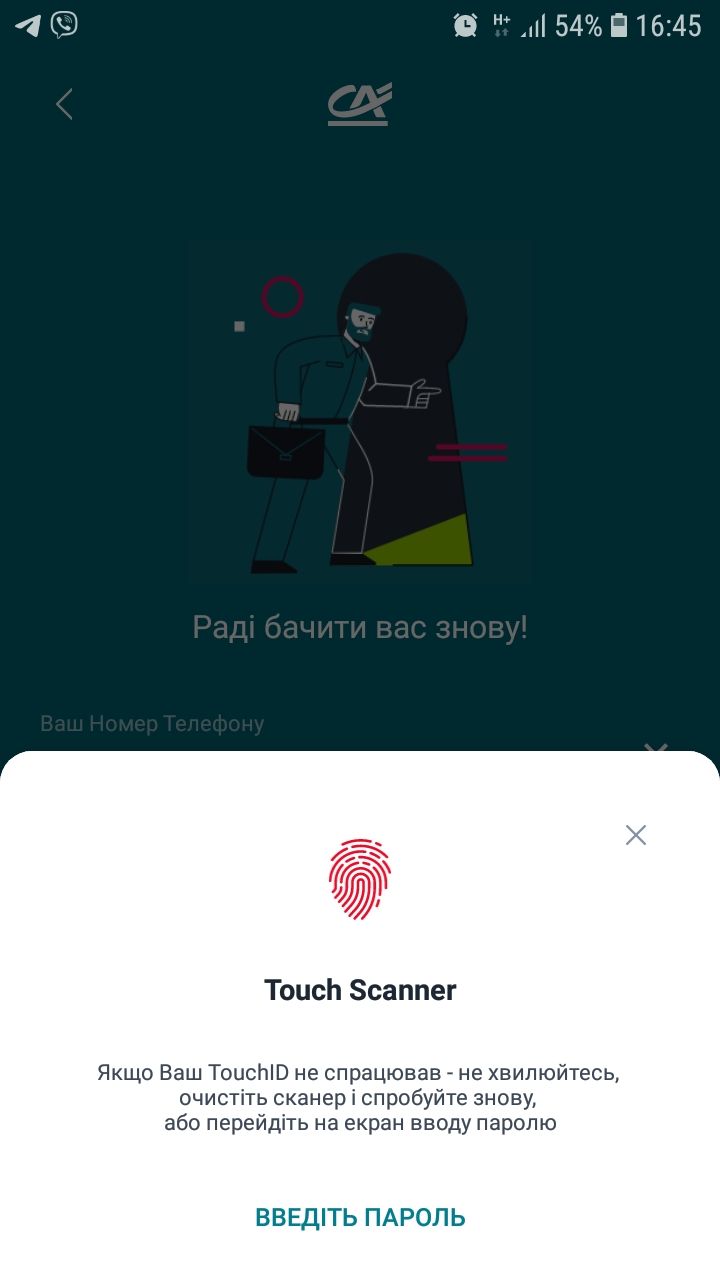

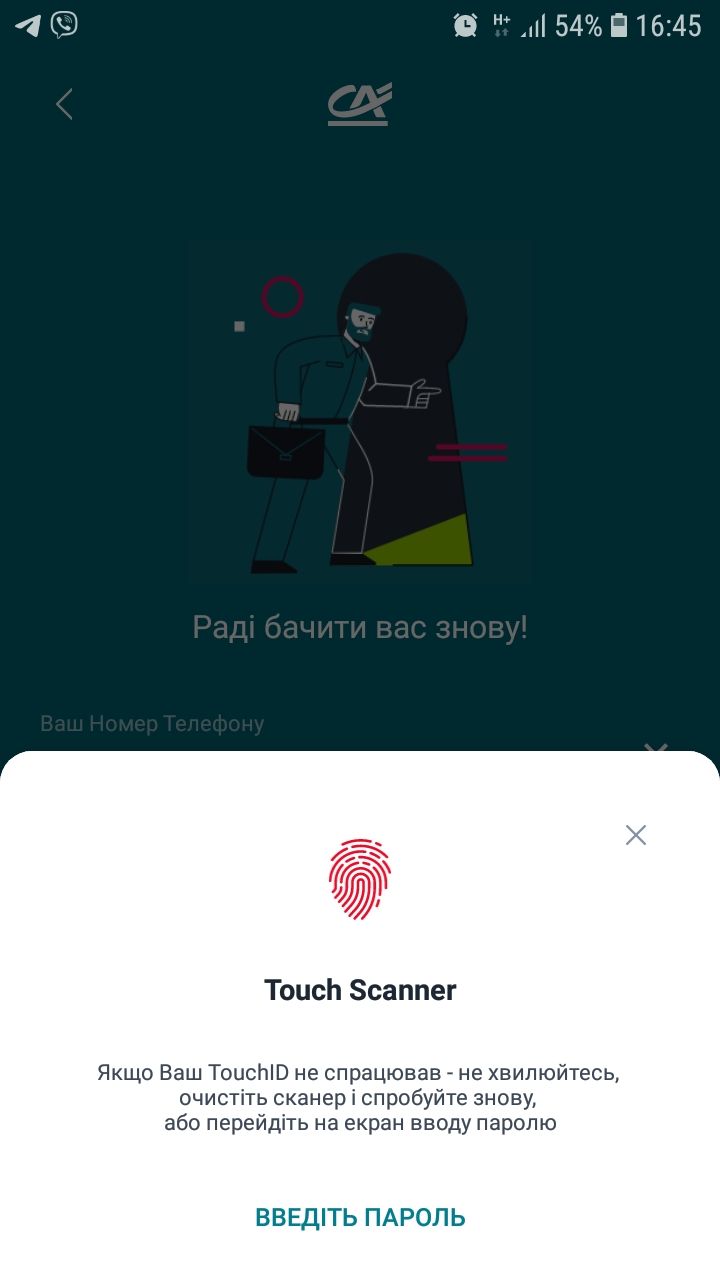

- Biometric login (fingerprint or face recognition). For devices where such option is not available – by short code or password.

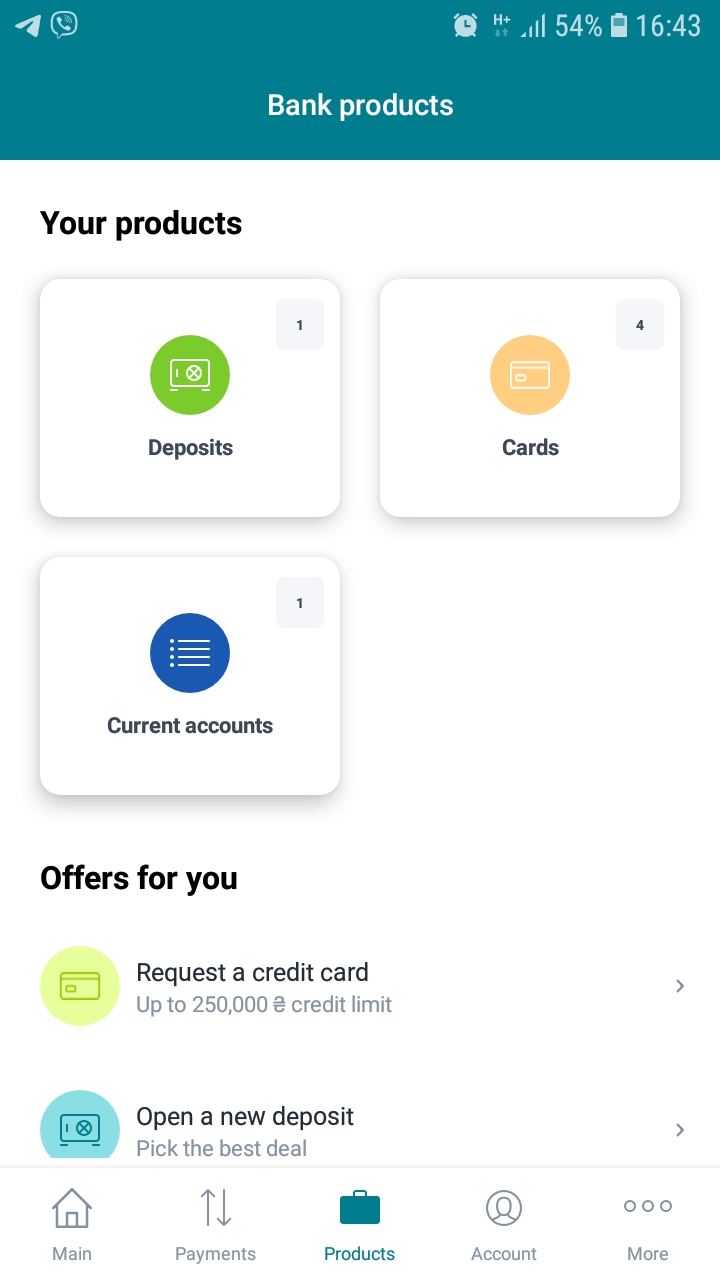

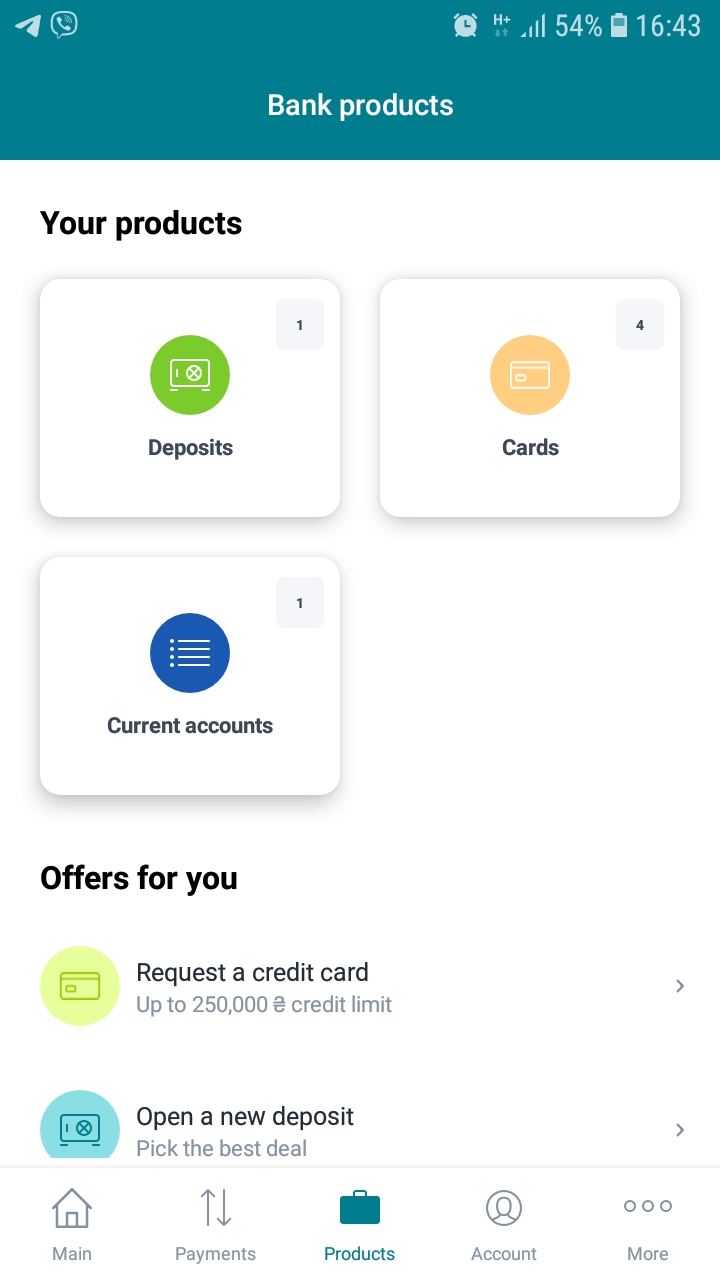

- Opening a deposit and submission of credit card application.

СА+ application is available in App Store and Google Play. You can also install it by scanning the QR-code below

To use new СА+ application, you need to log on even if you used the previous application as CA Mobile accounting data are not valid here. All you need for that is your card number or tax identification number.

“We want our mobile banking to be as convenient and functional as possible for our customers. Thus, we developed and launched the new СА+ within a record short period of time: less than a year. To identify and eliminate any drawbacks in the work of the application, it was beta-tested by more than 2,300 users. A powerful technical platform on which CA+ mobile banking is implemented allows to upgrade the application on a regular basis and to launch new services quickly. So, next steps in the development of digital services can be Internet banking for individuals, new service solutions for individual entrepreneurs, web-portal for customers, etc.”, Boris Guitton, Head of Digital Business Development Department of Credit Agricole Bank, comments.

The nearest releases of СА+ mobile banking will include:

- Expanded functionality of card management, in particular, adding them to Apple and Google wallets right from the application.

- Expanded opportunities of utility payment service.

- Review of transaction details, generation of statements and receipts.

- More online products like new deposits, cards and cash loan.

- Product personalization.

- Loyalty programs.

Now we are in a transition period when both applications are available for customers: new СА+ and previous CA Mobile. The previous CA Mobile application is no longer updated but it will work in a normal course for few more months. Precise dates of the transition period completion will be specified on the website of the bank in advance.

About Credit Agricole:

JSC “Credit Agricole Bank” is a modern universal bank owned by the leading financial group in Europe – Credit Agricole Group (France). The Group is a major partner of the French economy and one of the largest banking groups in Europe. It is a leading retail bank in Europe, having the largest portfolio of assets under management, being first in the field of ban insurance and third - in project financing in Europe. Credit Agricole has been operating in the financial market of Ukraine since 1993 and renders the entire range of banking services to private individuals, including premium-clients, and business. The bank pays special attention to cooperation with agricultural enterprises. Reliability and business reputation of Credit Agricole in Ukraine is confirmed by the highest possible FITCH ratings, leading positions in bank sustainability, bank deposit reliability and bank profitability rankings, as well as by 280 000 active private and 17 000 corporate customers, including international corporations, large Ukrainian companies and representatives of small and medium business. Credit Agricole Bank is a socially responsible bank that confirms its status by the large number of projects implemented under the Corporate Social Responsibility Program “We Care!”.

Contacts:

Viktoriia Torianyk, Head of PR and internal communications division of Credit Agricole Bank.

E-mail: Viktoriia.TORIANYK@credit-agricole.ua

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information

Useful information